Vietnam’s agricultural exports have long been a pillar of its economy, from natural rubber and cocoa to coffee and cocoa inputs. These sectors collectively employ millions and generate billions in export revenue each year.

But the introduction of the EU Deforestation Regulation (EUDR) marks a new era. Starting December 2025, every shipment of rubber, cocoa, palm oil, and related products entering the EU must be deforestation-free, legally produced, and fully traceable to its origin.

For Vietnam, one of Asia’s top agricultural exporters, the challenge is as much about data as it is about sustainability. Supply chains must evolve quickly to remain competitive in an increasingly proof-based trading system.

EUDR in Brief: A Regulation That Redefines Agricultural Trade

The EUDR covers seven key commodities: coffee, cocoa, cattle, palm oil, soy, rubber, and timber. Its core goal is to ensure that EU consumption no longer contributes to deforestation or forest degradation worldwide.

To comply, exporters must collect geolocation coordinates for farms or plantations, prove that no forest was cleared after December 31, 2020, and submit a due diligence statement before their goods reach EU markets.

Vietnam, now officially classified as a “low-risk” country under the EUDR, will face fewer inspections (around 1% of shipments). Yet exporters must still provide complete traceability records. The message from Brussels is clear: no proof, no access.

The Rubber Challenge: Smallholders and Fragmented Chains

Rubber is one of Vietnam’s biggest non-food agricultural exports, worth over USD 2.5 billion annually. But it is also one of the most fragmented supply chains. Roughly 60% of Vietnam’s rubber is produced by smallholder farmers managing plots under three hectares.

Traditionally, these farmers sell latex to informal collectors who mix outputs from dozens of farms before selling to processors. This structure makes it almost impossible to trace rubber back to individual plantations, a direct problem under EUDR rules.

To respond, the Vietnam Rubber Association (VRA) has launched pilot projects with major exporters and the Ministry of Agriculture and Rural Development. These projects are mapping farms, building cooperative networks, and digitizing transactions.

By early 2025, four Vietnamese enterprises had exported 4,600 tons of EUDR-compliant rubber, sourced from 17,500 hectares of verified plantations involving 6,000 smallholders. The reward was significant, with premiums of USD 150–300 per ton for “deforestation-free” rubber.

The next challenge is scale: turning pilot projects into nationwide standards that reach every smallholder and every batch of rubber latex.

Cocoa: A Small Sector with Big Sustainability Potential

Cocoa may be a niche crop in Vietnam, but it is emerging as a model for sustainable agriculture. The EU includes cocoa under EUDR because of its historical links to deforestation in Africa, yet Vietnam’s production profile is different: smaller, diversified, and often grown within agroforestry systems.

Projects like the EU-funded “Circular Economy Cocoa: From Bean to Bar” (worth €1.9 million) are helping farmers in the Central Highlands and Mekong Delta adopt regenerative farming methods. Cocoa trees are planted alongside shade crops and fruit trees, reducing pressure on forest land.

Local enterprises, supported by NGOs such as Helvetas and IDH, are testing digital traceability and carbon-footprint tracking. These systems link cocoa batches to individual farm plots and promote zero-waste processing using husks and pulp for organic fertilizer or biodegradable materials.

With Vietnam’s low-risk classification and growing international recognition for its premium chocolate, cocoa exporters are well positioned to turn EUDR compliance into a market advantage by targeting European buyers who now favor fully traceable, ethically sourced products.

Palm Oil: Vietnam’s Hidden Exposure

Vietnam is not a major palm oil producer, but it is a significant processor and re-exporter. The country imports large volumes of palm oil from Indonesia and Malaysia, refines or uses it in consumer goods manufacturing, and then exports finished products to the EU.

Under the EUDR, any palm-based product, from cooking oil to cosmetics, must be backed by geolocation data of the original plantation, even if it was processed in Vietnam.

This adds a layer of complexity for refiners and traders. Companies must now trace imported palm oil all the way back to compliant plantations in neighboring countries.

Leading Vietnamese refiners have already begun tightening contracts, requiring suppliers to provide plantation maps, legal documentation, and mill-to-tank traceability records. Some have reorganized storage systems to keep compliant and non-compliant materials physically separate.

Although this increases short-term costs, it helps Vietnam position itself as a regional compliance hub, a country where palm oil can be refined, verified, and re-exported to Europe under strict sustainability standards.

Building Data Systems: The New Currency of Trade

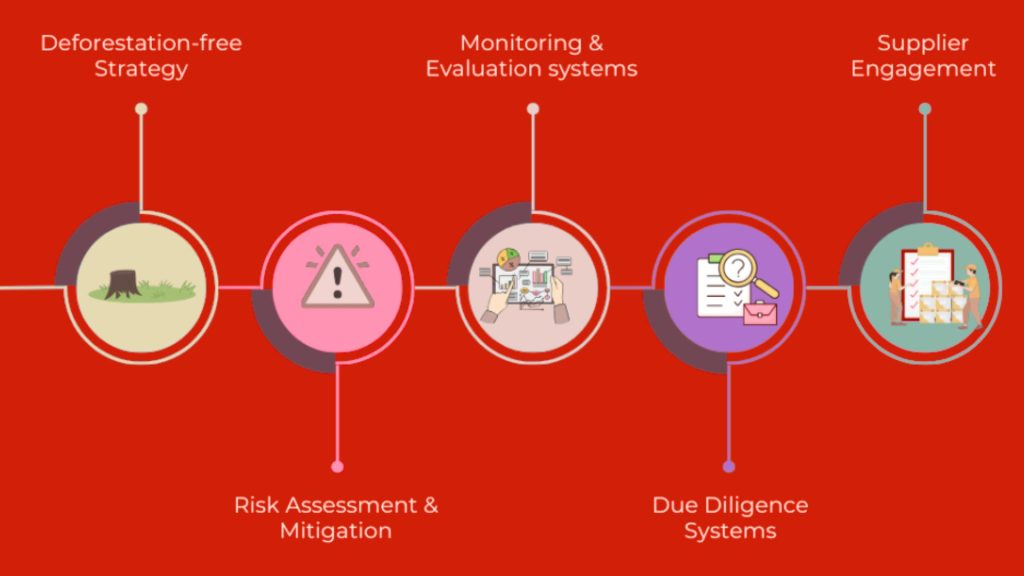

Across all commodities, traceability is now the central requirement. The EUDR pushes Vietnam’s agriculture toward digital transformation, forcing supply chains to shift from paper invoices to real-time data ecosystems.

Key initiatives include:

- MARD’s national traceability database, which integrates cadastral maps and land-use records for coffee, rubber, and cocoa.

- GIS and satellite tools like Trase and Satelligence, helping companies monitor deforestation risk zones.

- Blockchain and cloud platforms that link farm-level data to export shipments.

The goal is simple: every exported ton of raw or processed product should be verifiably linked to a legal, deforestation-free origin.

For many small and medium enterprises (SMEs), collaboration is key. Forming producer cooperatives and sharing data infrastructure can help spread costs and collectively meet EUDR standards.

A Compliance Burden ?

The EUDR is often seen as a compliance burden, but for Vietnam, it is also a business opportunity.

- Market Access: Maintaining smooth entry into the EU, a premium market with stable demand.

- Brand Value: “Deforestation-free” labeling enhances trust with buyers and consumers.

- Premium Pricing: Verified products can command higher prices, as seen in the rubber pilot projects.

- Green Investment: EUDR compliance aligns with global ESG standards, attracting sustainability-linked finance and partnerships.

The key will be supporting farmers and SMEs to join the transition, ensuring that the benefits of compliance flow across the entire supply chain, not just large exporters.

Conclusion: A New Playbook for Agricultural Exports

From rubber plantations in Đồng Nai to cocoa farms in Bến Tre, Vietnam’s agricultural supply chains are entering a new phase of accountability. Traceability is no longer optional; it is the passport to global markets.

By embracing digital systems, building transparent partnerships, and aligning with EUDR principles, Vietnam can turn sustainability into a strategic export strength.

For deeper insights into Vietnam’s readiness, pilot programs, and compliance strategies across key agricultural sectors, download FVSource’s EUDR White Paper 2025, a comprehensive guide for exporters navigating Europe’s new deforestation-free trade era.